OVERVIEW

The physical security market is projected to reach USD 127.06 billion by 2024, growing at a CAGR of 7.12% during the forecast period. The rising incidents of terror attacks, technological advancements and deployment of wireless technology in security systems are projected drive the growth of market. Moreover, the increasing use of Internet Protocol based cameras for video surveillance, and increasing adoption of Internet of Things (IoT)-based security systems with cloud computing platforms are also expected to propel the growth of the market.

TABLE OF CONTENT

1 Global Physical Security Market – Overview

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

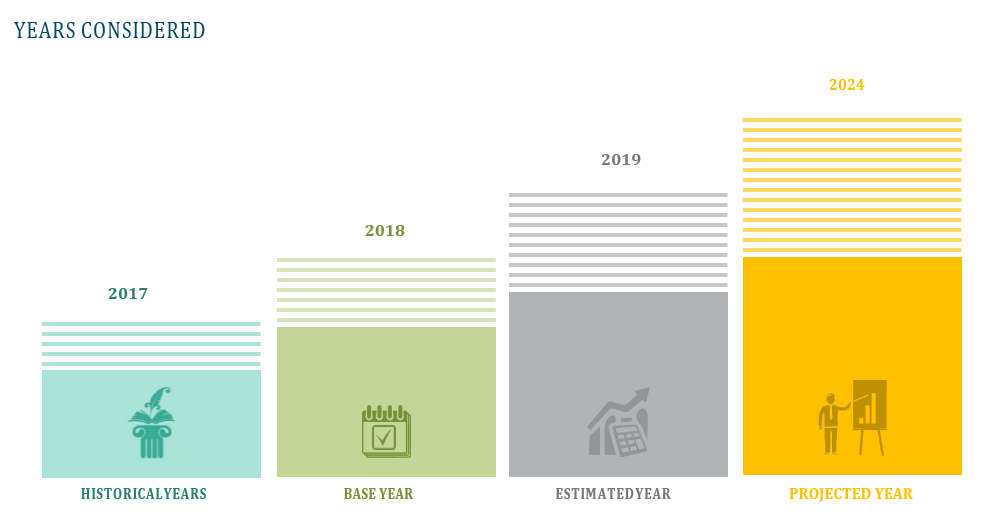

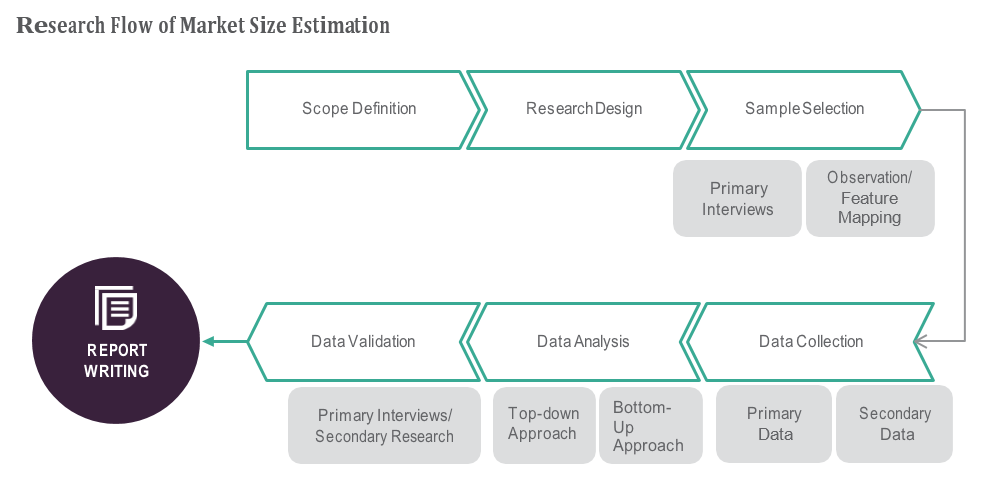

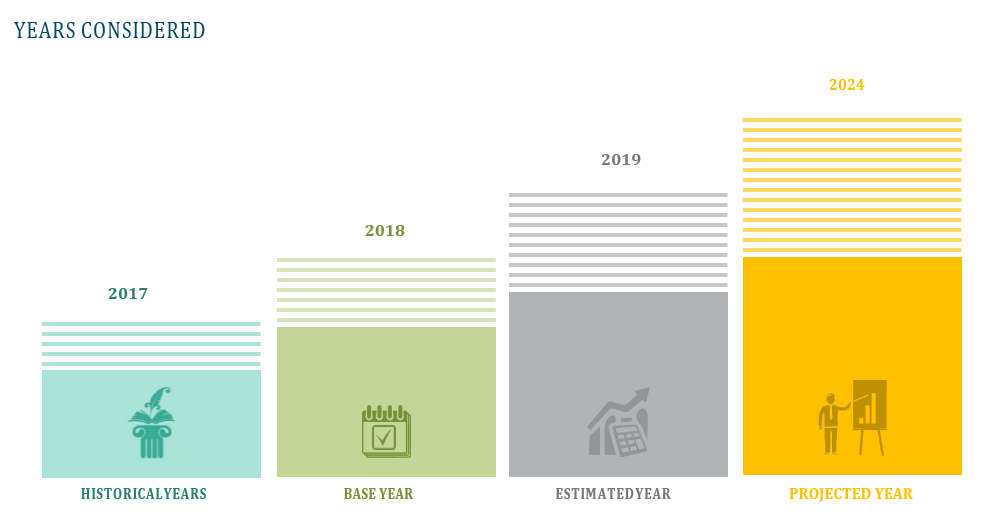

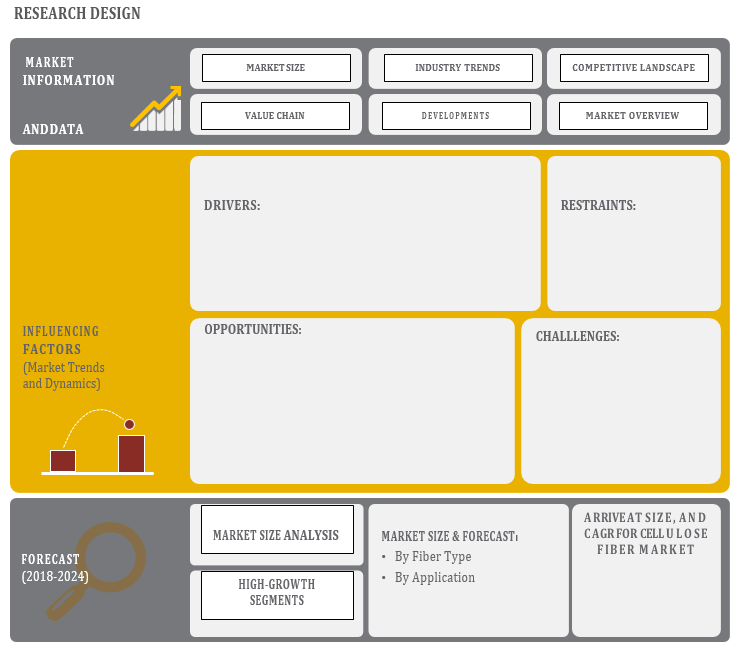

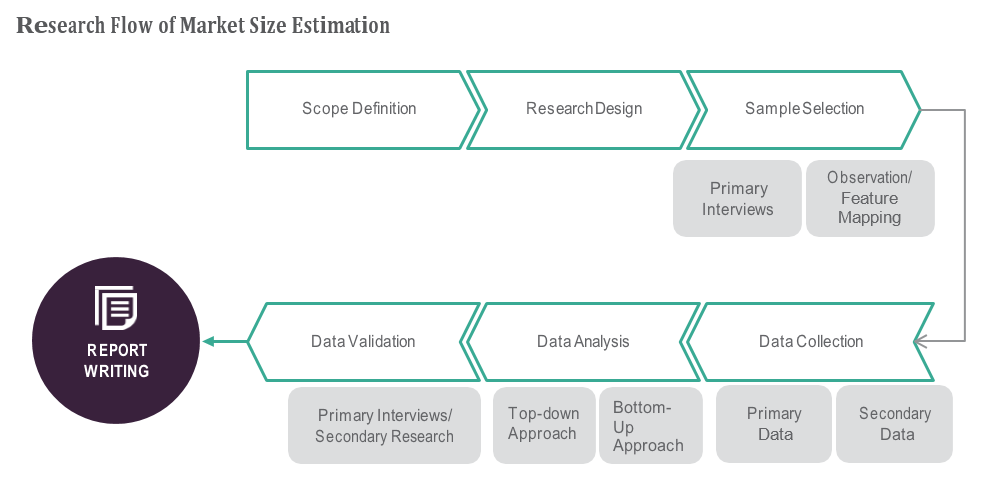

2 RESEARCH METHODOLOGY

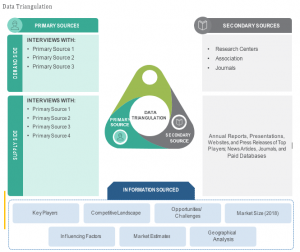

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

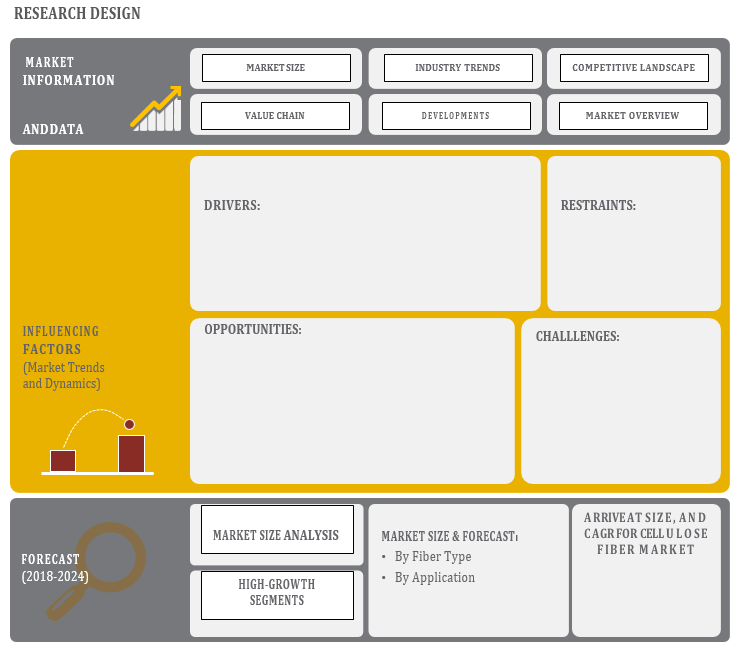

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

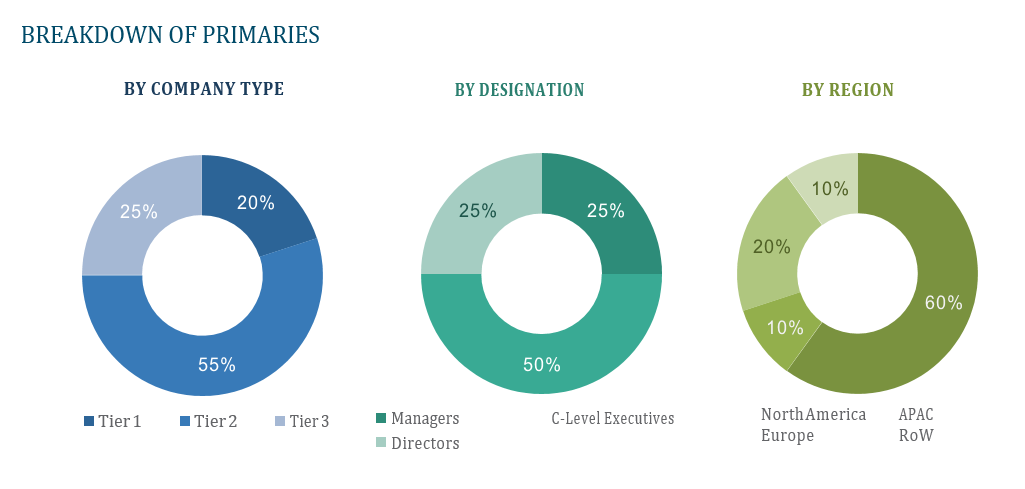

2.1.2.3 Breakdown of Primaries

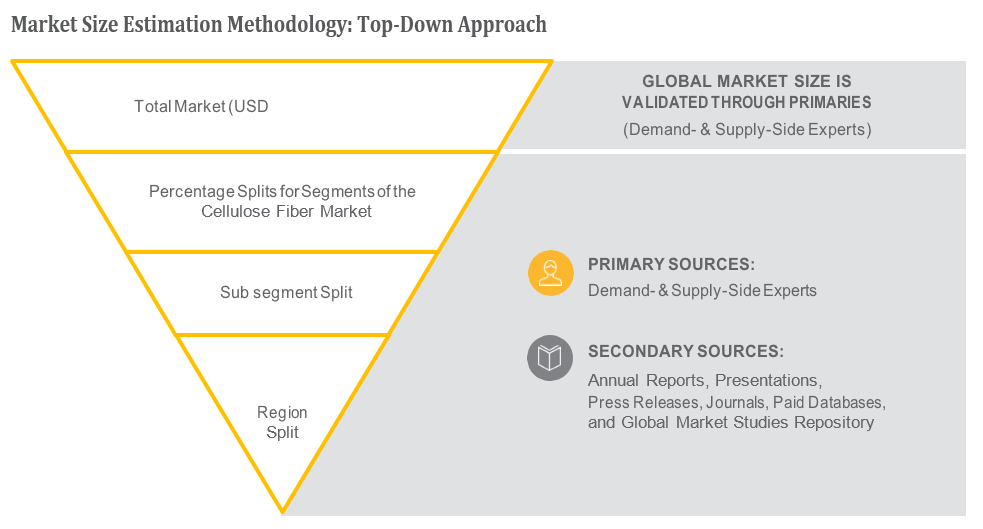

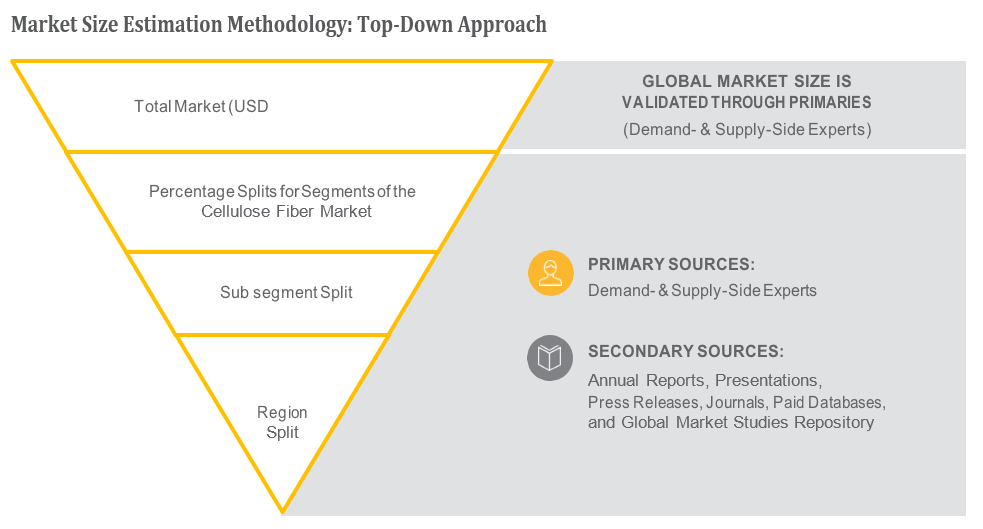

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

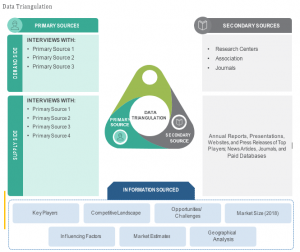

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Global Physical Security Market – Executive Summary

3.1 Market Revenue, Market Size and Key Trends by Company

3.2 Key Trends by type of Application

3.3 Key Trends segmented by Geography

4 Global Physical Security Market – Comparative Analysis

4.1 Product Benchmarking – Top 10 companies

4.2 Top 5 Financials Analysis

4.3 Market Value split by Top 10 companies

4.4 Patent Analysis – Top 10 companies

4.5 Pricing Analysis

5 Global Physical Security Market – Industry Market Entry Scenario

5.1 Regulatory Framework Overview

5.2 New Business and Ease of Doing business index

5.3 Case studies of successful ventures

5.4 Customer Analysis – Top 10 companies

6 Global Physical Security Market – Market Forces

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.2 Opportunities

6.2.3 Challenges

6.3 Porters Analysis of Market

6.3.1 Bargaining power of suppliers

6.3.2 Bargaining powers of customers

6.3.3 Threat of new entrants

6.3.4 Rivalry among existing players

6.3.5 Threat of substitutes

7 Global Physical Security Market – Strategic Analysis

7.1 Value Chain analysis

7.2 Product Life Cycle

7.3 Supplier and distributor analysis (Market share and product dealing strategies)

8 Global Physical Security Market – By Component (Market Size – & million/billion)

8.1 Services

8.1.1 Access Control as a Service (ACaaS)

8.1.2 Video Surveillance as a Service (VSaaS)

8.1.3 Remote Monitoring Services

8.1.4 Security Systems Integration Services

8.2 Systems

8.2.1 Physical Access Control System (PACS)

8.2.2 Video Surveillance System

8.2.3 Physical Security Information Management (PSIM)

8.2.4 Physical Identity and Access Management (PIAM)

8.2.5 Fire and Life Safety

9 Global Physical Security Market – By Organization Size

9.1 Small and medium-sized Enterprises

9.2 Large Enterprises

10 Global Physical Security Market – By Vertical

10.1 BFSI

10.2 Government

10.3 Retail

10.4 Transportation

10.5 Residential

10.6 Telecom and IT

10.7 Others

11 Global Physical Security Market – By Geography (Market Size – & million/billion)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K

11.3.2 Germany

11.3.3 Italy

11.3.4 France

11.3.5 Spain

11.3.6 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Rest of APAC

11.5 Rest of the World

11.5.1 South America

11.5.2 Middle East

11.5.3 Africa

12 Global Physical Security Market – Entropy

12.1 New product launches

12.2 M&A’s, collaborations, JVs and partnerships

13 Global Physical Security Market Company Profile (Key Players)

13.1 Market Share, Company Revenue, Products, M&A, Developments

13.2 ADT

13.3 Bosch Building Technologies

13.4 Cisco

13.5 Honeywell

13.6 Johnson Controls

13.7 Anixter

13.8 Genetec

13.9 Secom

13.10 Pelco By Schneider Electric

13.11 Zhejiang Dahua Technology Co.

13.12 Company 11 & more

14 Global Physical Security Market – Appendix

14.1 Sources

14.2 Abbreviations