OVERVIEW

The market size of the automotive wiring harness is projected to reach USD 51.7 billion by 2024, rising over the forecast period at a CAGR of 3.56 percent. The growth of the automotive cable harness market is driven by increased vehicle production and technology upgrading.

TABLE OF CONTENT

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

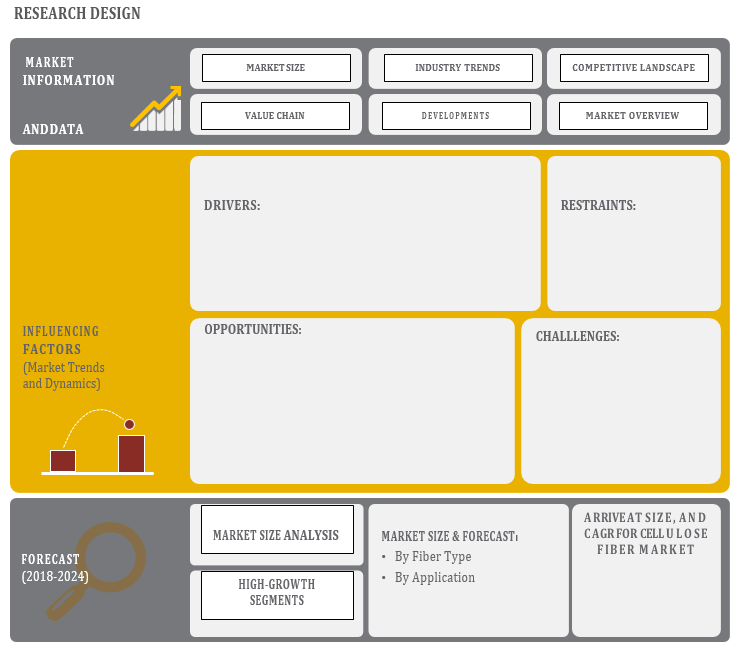

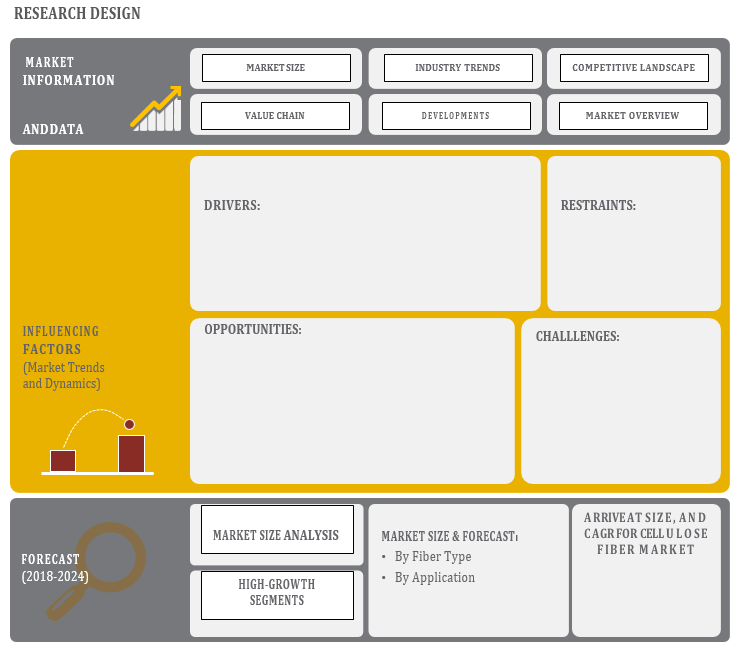

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 PRIMARY SOURCES

2.1.2.2 BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 MARKET SHARE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

4.1 INTRODUCTION

4.2 MARKET DYNAMICS

4.2.1 DRIVERS

4.2.2 RESTRAINTS

4.2.3 OPPORTUNITIES

4.2.4 CHALLENGES

5 INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 VALUE CHAIN

6 AUTOMOTIVE WIRING HARNESS MARKET, BY CATEGORY

6.1 INTRODUCTION

6.2 General Wires

6.3 Heat Resistant Wires

6.4 Shielded Wires

6.5 Tubed Wires

7 AUTOMOTIVE WIRING HARNESS MARKET, BY MATERIAL

7.1 INTRODUCTION

7.2 Copper

7.3 Aluminum

7.4 Others

8 AUTOMOTIVE WIRING HARNESS MARKET, BY APPLICATION

8.1 INTRODUCTION

8.2 Engine Harness

8.3 Chassis Wiring Harness

8.4 Battery Wiring Harness

8.5 Body & Lighting Harness

8.6 HVAC Wiring Harness

8.7 Dashboard/Cabin Harness

8.8 Sunroof Wiring Harness

8.9 Others

9 AUTOMOTIVE WIRING HARNESS MARKET, BY VEHICLE TYPE

9.1 INTRODUCTION

9.2 Commercial Vehicles

9.3 Passenger Cars

9.4 Others

10 GEOGRAPHIC ANALYSIS

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 UK

10.3.2 GERMANY

10.3.3 FRANCE

10.3.4 ITALY

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 SOUTH KOREA

10.4.4 INDIA

10.4.5 REST OF APAC

10.5 REST OF THE WORLD (ROW)

10.5.1 MIDDLE EAST

10.5.2 SOUTH AMERICA

10.5.3 AFRICA

11 MARKET ENTROPY

11.1 NEW PRODUCT LAUNCHES

11.2 M&A’s, COLLABORATIONS, JVs, AND PARTNERSHIPS

12 COMPANY PROFILES

12.1 INTRODUCTION

(Business overview, Products offered, Recent developments)*

12.2 KEY PLAYERS

12.2.1 Sumitomo Electric Industries

12.2.2 Yazaki Corporation

12.2.3 Aptiv PLC

12.2.4 Furukawa Electric

12.2.5 Leoni AG

12.2.6 Nexans

12.2.7 Lear Corporation

12.2.8 Fujikura Ltd.

12.2.9 Samvardhana Motherson Group

12.2.10 PKC Group Lucas TVs Ltd.

12.2.11 Company 11 & More

*Details on Business overview, Products offered, Recent developments might not be captured in case of unlisted companies.

13 APPENDIX

13.1 SOURCES

13.2 ABBREVIATIONS