OVERVIEW

The Automotive Transmission Market is expected to reach USD 190.1 billion, rising over the forecast period at a CAGR of 5.6%. The main drivers of this demand are the enhanced driving experience in terms of smooth gear shift and increased acceleration, which has led to an increase in vehicle production across developing countries.

TABLE OF CONTENT

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

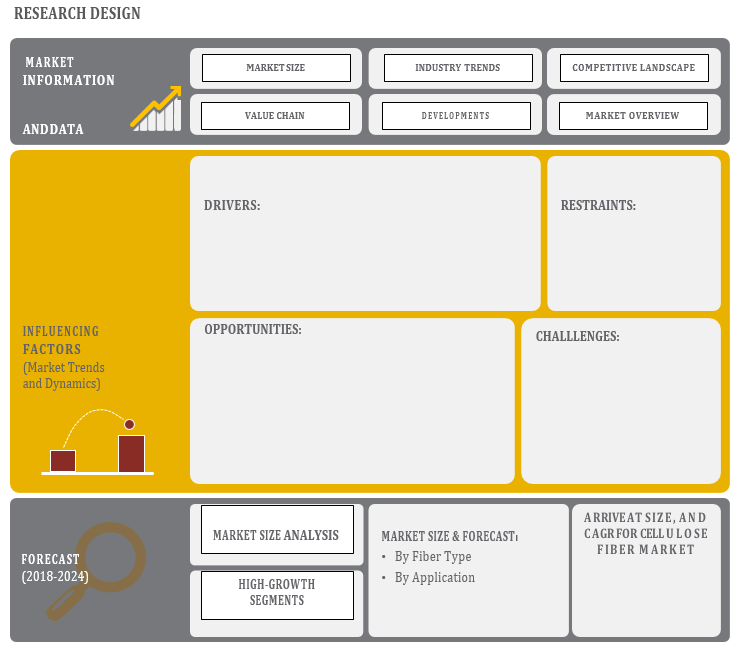

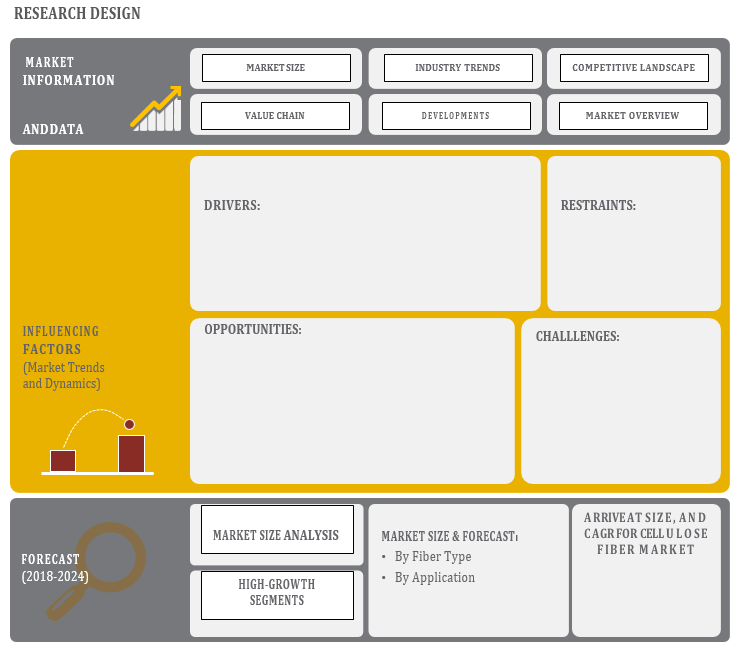

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 PRIMARY SOURCES

2.1.2.2 BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 MARKET SHARE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

4.1 INTRODUCTION

4.2 MARKET DYNAMICS

4.2.1 DRIVERS

4.2.2 RESTRAINTS

4.2.3 OPPORTUNITIES

4.2.4 CHALLENGES

5 INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 VALUE CHAIN

6 AUTOMOTIVE TRANSMISSION MARKET, BY TRANSMISSION TYPE

6.1 INTRODUCTION

6.2 Automatic

6.3 Manual

6.4 Automatic Manual transmission (AMT)

6.5 Dual Clutch Transmission (DCT)

6.6 Continuous Variable Transmission (CVT)

7 AUTOMOTIVE TRANSMISSION MARKET, BY FUEL TYPE

7.1 INTRODUCTION

7.2 Gasoline

7.3 Diesel

8 AUTOMOTIVE TRANSMISSION MARKET, BY NUMBER OF GEARS

8.1 INTRODUCTION

8.2 Molten Carbonate Fuel Cell

8.3 Solid Oxide Fuel Cell

9 AUTOMOTIVE TRANSMISSION MARKET, BY VEHICLE TYPE

9.1 INTRODUCTION

9.2 Commercial Vehicles

9.3 Passenger Cars

9.4 Others

10 GEOGRAPHIC ANALYSIS

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 UK

10.3.2 GERMANY

10.3.3 FRANCE

10.3.4 ITALY

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 SOUTH KOREA

10.4.4 INDIA

10.4.5 REST OF APAC

10.5 REST OF THE WORLD (ROW)

10.5.1 MIDDLE EAST

10.5.2 SOUTH AMERICA

10.5.3 AFRICA

11 MARKET ENTROPY

11.1 NEW PRODUCT LAUNCHES

11.2 M&A’s, COLLABORATIONS, JVs, AND PARTNERSHIPS

12 COMPANY PROFILES

12.1 INTRODUCTION

(Business overview, Products offered, Recent developments)*

12.2 KEY PLAYERS

12.2.1 Continental AG

12.2.2 Eaton Corporation PLC.

12.2.3 Aisin Seiki Co. Ltd.

12.2.4 Borgwarner Inc.

12.2.5 Schaeffler AG

12.2.6 ZF Friedrichshafen AG

12.2.7 Magna International

12.2.8 JatcoLtd

12.2.9 Allison Transmission Inc.

12.2.10 GKN PLC

12.2.11 Country 11 & More

*Details on Business overview, Products offered, Recent developments might not be captured in case of unlisted companies.

13 APPENDIX

13.1 SOURCES

13.2 ABBREVIATIONS